-

Corporate Tax

We are your problem solvers for corporate tax issues

-

Restructuring, Mergers & Acquisition

Expertise and creativity for the perfect structure

-

International Tax

We are here, whenever our clients require our assistance

-

Transfer pricing

We are your experts for an optimal transfer pricing structure

-

Indirect Tax & Customs

We take care of your indirect taxes so you can take care of your business

-

Private Wealth

We are your competent partner in the field of Private Wealth Tax Services

-

Real Estate Tax

We are a valuable partner at every stage of your property's life

-

Global Mobility Services

Local roots and global networking as a secret for successful assignment management

-

Advisor for Advisor

As advisors for advisors, we support in complex situations

-

Accounting & Tax Compliance Services

Grant Thornton Austria - Your Partner for Experts for Accounting & Tax Compliance Services. In an evolving regulatory landscape, efficient accounting, tax compliance, and financial statement preparation processes are crucial for maintaining an accurate and up-to-date view of your company’s financial position while ensuring compliance with all legal requirements. We provide tailored solutions that not only save your time and resources but also ensure compliance with complex regulations. Our experts are here to support you, allowing you to focus on your core business.

-

Payroll & People Advisory Services

Ensuring Compliance, Efficiency, and Strategic HR Solutions In an evolving legal landscape, it is crucial for companies of all sizes to have efficient and legally compliant payroll accounting systems. The ever-changing regulations and increasing complexity make this an ongoing challenge. At Grant Thornton Austria, we provide comprehensive, precise payroll processing as part of our Payroll & People Advisory Services. Additionally, we offer customized advisory services to help clients optimise their HR strategy, improve operational efficiency, and minimize potential risks.

-

Tax Controversy Services

Your Partner when it matters most! In increasingly complex environment and considering frequent changes in tax regulations, businesses are facing intensified scrutiny from tax authorities. This has resulted in a significant rise of complex tax audits, investigations and potential disputes. Our Tax Controversy Services are tailored to help you navigate these challenges proactively and effectively. Our experts will guide you through all stages of tax proceedings, ensuring robust defence of your position and advising you on preventive measures to minimize the risk of future tax disputes.

-

Tax Technology Services

Your digital partner for an efficient future! In an increasingly digitalised business world, companies must constantly look for optimisations and adjustments to ensure their long-term success. In order to best prepare for the future and to achieve efficiency increases and process optimisations in the digital area, the experts at Grant Thornton Austria are at your side as a reliable partner as part of our Tax Technology Services.

-

Audit of annual and consolidated financial statements

We place particular emphasis on customized solutions and international service and adapt our services to your needs.

-

Assurance related advisory services

Assurance related advisory services are based on the knowledge and expertise that are the staff of life of our auditors.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

-

Accounting related consulting

Accounting in accordance with UGB, US-GAAP or IFRS is in constant motion. The integration of new regulations into their own accounting systems poses special challenges for companies.

-

Valuation

Valuations are a core competence of Grant Thornton Austria. As auditors and tax advisors we combine profound know-how with our practical experience to offer you customized solutions for your valuation assignment. Our industry expertise is based on years of services to our clients, including listed companies as well as owner-managed companies with an international focus. We advise on valuation matters related to arbitration and provide expert opinions.

-

Forensic Services

When it comes to risks in business, our experts are on hand. We support you not only in suspicious cases or in disputes, but also develop suitable strategies in the area of prevention to avoid serious cases as far as possible. Our Cyber Security team helps you to keep your networks and applications secure and is quickly on hand in the event of a security leak.

-

Cyber Security

Cyber incidents, IT system failures, the resulting business interruptions and the loss of critical data are one of the greatest business risks for companies. Recent cases underline the need for strategic protection and awareness of the issue and require a holistic approach and technical expertise that takes into account all legislative, regulatory and technical aspects of cyber security to protect companies against the daily increase in cybercrime incidents.

-

Sustainability Services

Sustainability is no longer a trend, but the only way to create a future worth living. Our experts will support you in successfully developing your sustainability strategy and preparing your sustainability reporting in compliance with regulations.

-

Transaction Support

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Merger & Acquisition

Companies start new activities and separate from old ones, cooperate and merge. Markets and competitive conditions are subject to constant and increasingly rapid change. As a result, existing business models are changing. Some companies have to restructure and reorganize. But new business opportunities also open up.

-

Restructuring & Going Concern Forecast

Restructuring & Going Concern Forecast: Bundled services for your strategic, operational and financial decisions offer the right answers for companies, banks, shareholders and investors.

-

Internal Audit

Internal Audit helps companies and organisations to achieve their goals by analysing and evaluating the effectiveness of risk management, controls and management and monitoring processes. Internal Audit focuses on independent and objective audit (assurance) and consulting services that improve the value creation and business activities of your company.

-

Expert dispute resolution & advisory

Grant Thornton Austria offers comprehensive services in the field of business-oriented expert services with a broad range of competencies from banking to communication. The core activity of experts is the objective recording of findings and the preparation of expert opinions - regardless of all external circumstances. Our experts Gottwald Kranebitter and Georg H. Jeitler, as sworn and court-certified experts, ensure that the highest professional standards and the principle of objectivity are observed.

-

Blockchain and Crypto-Asset

Blockchain as a carrier technology for crypto currencies and smart contracts, among other things, is becoming increasingly important. Grant Thornton Austria offers comprehensive audit and confirmation services for block chain technologies and business models.

-

International Project Coordination

Our International Engagement Management team is your central point of contact for international projects in all our service lines. We take care of operational project management for you and act as a central point of contact and coordination for your projects. We support companies that start international projects from Austria as well as companies from abroad that want to gain a foothold in Austria or use Austria as a hub for their international projects, especially in the DACH (Germany, Austria and Switzerland) and CEE region.

-

International Desks

As a member of the Grant Thornton network, we guarantee direct access to resources from our worldwide circle of partners. This global connection enables us to seamlessly integrate highly qualified specialists and industry experts from different countries around the world into our teams. Through our broad perspective and diverse expertise, we ensure that we can optimally meet the individual requirements of our clients in an increasingly globalised economy.

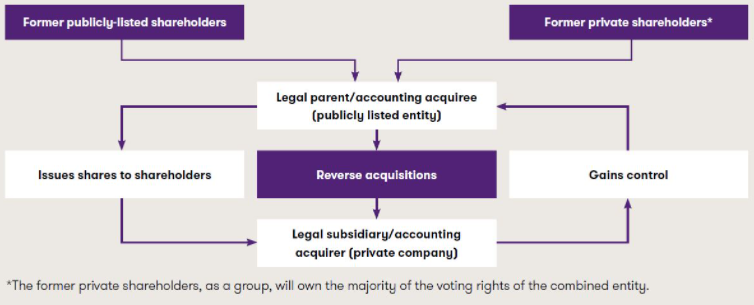

Our ‘Insights into IFRS 3’ series summarises the key areas of the Standard, highlighting aspects that are challenging to interpret and apply in practice. This article follows on from our published article ‘Insights into IFRS 3 – Identifying the acquirer’ and presents guidance for an area which is difficult in practice – reverse acquisitions.

What is a reverse acquisition?

A reverse acquisition occurs when an entity that issues securities (the legal parent or the legal acquirer) is identified as the accounting acquiree, and accordingly, the legal subsidiary (or the legal acquiree) is identified as the accounting acquirer.

One situation in which reverse acquisitions often arise is when a private operating entity wants a fast-track to a public listing. To accomplish this, the private entity arranges for its equity interests to be acquired by a smaller, publicly listed entity. The listed entity carries out the acquisition by issuing shares to the shareholders of the private operating entity. After the exchange of shares, the former shareholders of the private entity, as a group, hold the majority of the voting rights of the combined entity. In addition, the former shareholders of the private entity then appoint the majority of the members of the new combined entity’s board. In this case, although the publicly listed entity issued shares to acquire the private entity, the listed entity will be identified as the accounting acquiree and the private entity as the accounting acquirer as the former shareholders of the private entity, as a group, have obtained the control over the combined entity.

This is explained in the following diagram:

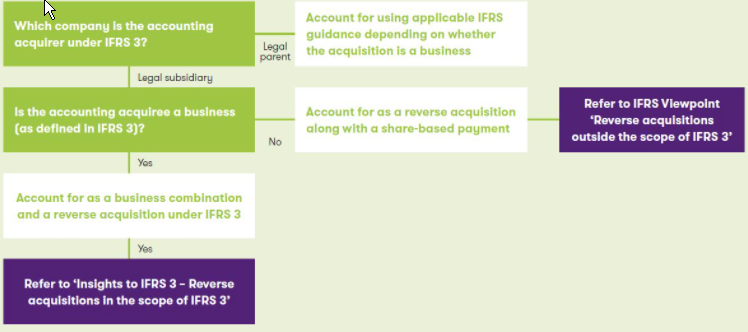

Is the reverse acquisition transaction a business combination?

Answering this question involves determining:

- which company is the ‘accounting acquirer’ under IFRS 3, ie the company that obtains effective control over the other, and

- whether or not the acquired company (ie the ‘accounting acquiree’) is a business as defined in IFRS 3.

Identifying the acquirer

When a transaction between entities is carried out primarily by exchanging shares, the entity that obtains the control over the other entity is the accounting acquirer. Although IFRS 3 indicates to use the guidance in IFRS 10 to identify such acquirer, in practice, the factors listed in IFRS 3 with regards to the transactions effected by an exchange of equity interests should also be analysed. Refer to our article ‘Insights into IFRS 3 – Identifying the acquirer’ for more details on this guidance.

The following facts and circumstances are likely to indicate the legal subsidiary is the accounting acquirer:

- the former shareholders of the legal subsidiary, as a group, retain or receive the largest portion of the voting rights in the new combined entity (which include potential voting rights that could be exercised)

- the relative size (measured in, for example, assets, revenues or profit) of the legal subsidiary is significantly greater than that of the legal parent

- the former owners or managers of the legal subsidiary dominate the composition of the governing body or senior management of the combined entity.

PRACTICAL INSIGHT

-

The IFRS Interpretations Committee (IFRIC) received a request to clarify whether a business (legally acquired) that is not a legal entity could be considered to be the accounting acquirer in a reverse acquisition under IFRS 3. In September 2011, the IFRIC observed that IFRS standards do not require a ‘reporting entity’ to be a legal entity. Therefore, an acquirer that is a ‘reporting entity’ but not a legal entity can be considered to be an accounting acquirer in a reverse acquisition. This IFRIC decision has raised some issues in practice on how to determine the boundaries of the assets and liabilities of the business and the nature of the equity that is transferred.

What if the legal acquirer transfers also cash?

When a legal parent pays cash to acquire shares in a subsidiary the transaction would normally be accounted for as a regular business combination, ie considering the entity that is transferring cash is the acquirer. However, in some circumstances the business combination can still be considered a reverse acquisition even if cash is transferred from the legal parent to the owners of the legal subsidiary where other facts demonstrate the legal subsidiary is finally the accounting acquirer.

An important determining factor in identifying the acquirer is control. When it is clear as part of this transaction the legal subsidiary has obtained control over the legal parent (in accordance with the definition of control as stated in IFRS 10 ‘Consolidated Financial Statements’), the transaction should then be accounted for as a reverse acquisition. While this is a possible scenario, and one that can be challenging to deal with in practice, we do not believe reverse acquisitions with a payment in cash are common in practice.

What is a business?

This is one of the most commonly asked application questions in practice, in part because the answer makes a significant difference to how the transaction is accounted for. IFRS 3 includes both a definition of a business and some detailed supporting guidance.

What are the minimum requirements to meet the definition of a business?

IFRS 3 acknowledges that despite most businesses having outputs, outputs are not necessary for an integrated set of assets and activities to qualify as a business. In order to meet the definition of a business, the acquired set of activities and assets must have as a minimum an input and a substantive process that can collectively significantly contribute to the creation of outputs.

DEFINITION

-

A business is defined as ‘An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing goods or services to customers, generating investment income (such as dividends or interest) or generating other income from ordinary activities.’

Furthermore, IFRS 3 includes an optional concentration test that could be relevant in the present context. Refer to our article ‘Insights into IFRS 3 – Definition of a business’ for more details, Including how to apply the optional concentration test. In our view, a listed shell company that has no current substantive operations, and whose activities mainly involved managing its cash balances and filing obligations, would not meet the criteria of a business. This is because it has no substantive processes. For this reason, we consider many transactions in which a private operating company arranges to be acquired by a listed shell company are not business combinations and therefore fall outside the scope of IFRS 3.

How to account for a reverse acquisition

The following diagram illustrates the two possible accounting treatments, with reference to the relevant publications, when facing a reverse acquisition:

How we can help

We hope you find the information in this article helpful in giving you some insight into IFRS 3. If you would like to discuss any of the points raised, please speak to our experts Christoph Zimmel and Rita Gugl.