-

Corporate Tax

We are your problem solvers for corporate tax issues

-

Restructuring, Mergers & Acquisition

Expertise and creativity for the perfect structure

-

International Tax

We are here, whenever our clients require our assistance

-

Transfer pricing

We are your experts for an optimal transfer pricing structure

-

Indirect Tax & Customs

We take care of your indirect taxes so you can take care of your business

-

Private Wealth

We are your competent partner in the field of Private Wealth Tax Services

-

Real Estate Tax

We are a valuable partner at every stage of your property's life

-

Global Mobility Services

Local roots and global networking as a secret for successful assignment management

-

Advisor for Advisor

As advisors for advisors, we support in complex situations

-

Accounting & Tax Compliance Services

Grant Thornton Austria - Your Partner for Experts for Accounting & Tax Compliance Services. In an evolving regulatory landscape, efficient accounting, tax compliance, and financial statement preparation processes are crucial for maintaining an accurate and up-to-date view of your company’s financial position while ensuring compliance with all legal requirements. We provide tailored solutions that not only save your time and resources but also ensure compliance with complex regulations. Our experts are here to support you, allowing you to focus on your core business.

-

Payroll & People Advisory Services

Ensuring Compliance, Efficiency, and Strategic HR Solutions In an evolving legal landscape, it is crucial for companies of all sizes to have efficient and legally compliant payroll accounting systems. The ever-changing regulations and increasing complexity make this an ongoing challenge. At Grant Thornton Austria, we provide comprehensive, precise payroll processing as part of our Payroll & People Advisory Services. Additionally, we offer customized advisory services to help clients optimise their HR strategy, improve operational efficiency, and minimize potential risks.

-

Tax Controversy Services

Your Partner when it matters most! In increasingly complex environment and considering frequent changes in tax regulations, businesses are facing intensified scrutiny from tax authorities. This has resulted in a significant rise of complex tax audits, investigations and potential disputes. Our Tax Controversy Services are tailored to help you navigate these challenges proactively and effectively. Our experts will guide you through all stages of tax proceedings, ensuring robust defence of your position and advising you on preventive measures to minimize the risk of future tax disputes.

-

Tax Technology Services

Your digital partner for an efficient future! In an increasingly digitalised business world, companies must constantly look for optimisations and adjustments to ensure their long-term success. In order to best prepare for the future and to achieve efficiency increases and process optimisations in the digital area, the experts at Grant Thornton Austria are at your side as a reliable partner as part of our Tax Technology Services.

-

Audit of annual and consolidated financial statements

We place particular emphasis on customized solutions and international service and adapt our services to your needs.

-

Assurance related advisory services

Assurance related advisory services are based on the knowledge and expertise that are the staff of life of our auditors.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

-

Accounting related consulting

Accounting in accordance with UGB, US-GAAP or IFRS is in constant motion. The integration of new regulations into their own accounting systems poses special challenges for companies.

-

Valuation

Valuations are a core competence of Grant Thornton Austria. As auditors and tax advisors we combine profound know-how with our practical experience to offer you customized solutions for your valuation assignment. Our industry expertise is based on years of services to our clients, including listed companies as well as owner-managed companies with an international focus. We advise on valuation matters related to arbitration and provide expert opinions.

-

Forensic Services

When it comes to risks in business, our experts are on hand. We support you not only in suspicious cases or in disputes, but also develop suitable strategies in the area of prevention to avoid serious cases as far as possible. Our Cyber Security team helps you to keep your networks and applications secure and is quickly on hand in the event of a security leak.

-

Cyber Security

Cyber incidents, IT system failures, the resulting business interruptions and the loss of critical data are one of the greatest business risks for companies. Recent cases underline the need for strategic protection and awareness of the issue and require a holistic approach and technical expertise that takes into account all legislative, regulatory and technical aspects of cyber security to protect companies against the daily increase in cybercrime incidents.

-

Sustainability Services

Sustainability is no longer a trend, but the only way to create a future worth living. Our experts will support you in successfully developing your sustainability strategy and preparing your sustainability reporting in compliance with regulations.

-

Transaction Support

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Merger & Acquisition

Companies start new activities and separate from old ones, cooperate and merge. Markets and competitive conditions are subject to constant and increasingly rapid change. As a result, existing business models are changing. Some companies have to restructure and reorganize. But new business opportunities also open up.

-

Restructuring & Going Concern Forecast

Restructuring & Going Concern Forecast: Bundled services for your strategic, operational and financial decisions offer the right answers for companies, banks, shareholders and investors.

-

Internal Audit

Internal Audit helps companies and organisations to achieve their goals by analysing and evaluating the effectiveness of risk management, controls and management and monitoring processes. Internal Audit focuses on independent and objective audit (assurance) and consulting services that improve the value creation and business activities of your company.

-

Expert dispute resolution & advisory

Grant Thornton Austria offers comprehensive services in the field of business-oriented expert services with a broad range of competencies from banking to communication. The core activity of experts is the objective recording of findings and the preparation of expert opinions - regardless of all external circumstances. Our experts Gottwald Kranebitter and Georg H. Jeitler, as sworn and court-certified experts, ensure that the highest professional standards and the principle of objectivity are observed.

-

Blockchain and Crypto-Asset

Blockchain as a carrier technology for crypto currencies and smart contracts, among other things, is becoming increasingly important. Grant Thornton Austria offers comprehensive audit and confirmation services for block chain technologies and business models.

-

International Project Coordination

Our International Engagement Management team is your central point of contact for international projects in all our service lines. We take care of operational project management for you and act as a central point of contact and coordination for your projects. We support companies that start international projects from Austria as well as companies from abroad that want to gain a foothold in Austria or use Austria as a hub for their international projects, especially in the DACH (Germany, Austria and Switzerland) and CEE region.

-

International Desks

As a member of the Grant Thornton network, we guarantee direct access to resources from our worldwide circle of partners. This global connection enables us to seamlessly integrate highly qualified specialists and industry experts from different countries around the world into our teams. Through our broad perspective and diverse expertise, we ensure that we can optimally meet the individual requirements of our clients in an increasingly globalised economy.

Usually non-current assets are measured in the financial statements at either cost or revalued amount. However, IAS 36 ‘Impairment of Assets’ requires assets to be carried at no more then their revalued amount and any difference to be recorded as an impairment. However, its requirements of when and if to undertake an impairment review are sometimes challenging to apply in practice.

The articles in our ‘Insights into IAS 36’ series have been written to assist preparers of financial statements and those charged with the governance of reporting entities understand the requirements set out in IAS 36, and revisit some areas where confusion has been seen in practice. This article, explains if and when to undertake an impairment review.

This article explains if and when a detailed impairment test as set out in IAS 36 is required. The guidance prescribes different requirements for goodwill and indefinite life intangible assets (including those not ready for use) when compared to all other assets. As such, this article will cover Step 3 in the impairment review which is to determine if and when to test for impairment is needed.

For a summary of the steps in applying IAS 36, refer to our article ‘Insights into IAS 36 – Overview of the Standard’.

Step 3: If and when an entity should test for impairment

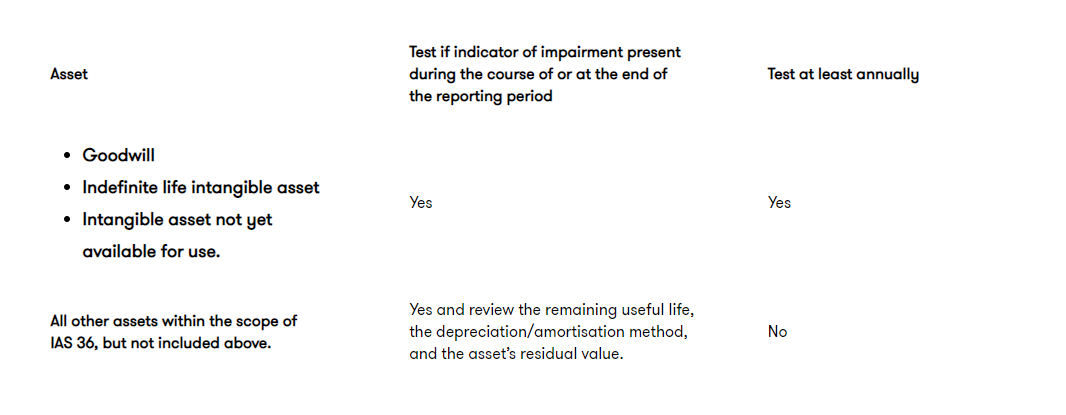

IAS 36 requires an entity to a perform a quantified impairment test (ie to estimate the recoverable amount):

- if at the end of each reporting period, there is any indication of impairment for the individual asset or CGU (indicator-based impairment), and

- annually for the following types of assets, irrespective of whether there is an indication of impairment:

- intangible assets with an indefinite useful life

- intangible assets not yet available for use, and

- goodwill acquired in a business combination.

Timing requirements for impairment testing by asset type are as follows:

Indicator-based impairment testing

IAS 36 requires an entity to assess at the end of each reporting period whether there is any indication that an asset or CGU may be impaired. This requirement also applies to goodwill, indefinite life intangible assets, and intangible assets not yet ready for use (although, in practice, an indicator review is necessary only at period ends that do not coincide with the annual test). If any such indication exists, the entity should estimate the recoverable amount of the asset or CGU. The process to estimate the recoverable amount is discussed in our article ‘Insights in IAS 36: Estimating recoverable amount’.

Indicators - IAS 36 provides a non-exhaustive list of external, internal and other indicators that an entity should consider, summarised these are as follows:

External sources of information

- Observable indications of a significant and unexpected decline in market value.

- Significant negative changes (have occurred or are expected) in the technological, market, economic or legal environment.

- Market interest rates or other market rates of return on investments have increased (which will increase the discount rate used in calculating an asset’s VIU).

- Carrying amount of the net assets of the entity is more than its market capitalisation.

Internal sources of information

- Evidence is available of obsolescence or physical damage of an asset.

- Significant negative changes (have occurred or are expected) in the extent to which an asset is (or is expected to be used) (eg an asset becoming idle, plans to discontinue or dispose of the asset before the previously expected date, and reassessing the useful life of an asset as finite rather than indefinite).

- Evidence is available from internal reporting that indicates the economic performance of an asset is, or will be, worse than expected.

Other indicators

- For an investment in a subsidiary, joint venture or associate, the investor recognises a dividend from the investment and evidence is available that:

- the carrying amount of the investment in the separate financial statements exceeds the carrying amount in the consolidated financial statements of the investee’s net assets, including associated goodwill, or

- the dividend exceeds the total comprehensive income of the subsidiary, joint venture or associate in the period the dividend is declared.

- The fact that an active market no longer exists for a revalued intangible asset.

Generally, internal indicators would provide reasonably direct evidence that a specific asset or CGU may be impaired. For example, internal reports might show:

- cash flows for acquiring the asset or CGU, or subsequent cash needs for operating or maintaining it, are significantly higher than those originally budgeted

- actual net cash flows or operating profit or loss flowing from the asset or CGU are significantly worse than those budgeted

- a significant decline in budgeted net cash flows or operating profit, or a significant increase in budgeted loss, flowing from the asset or CGU, or

- operating losses or net cash outflows for the asset or CGU, when current period amounts are aggregated with budgeted amounts for the future.

However, external sources of information will more typically be broader and less clearly linked to a specific asset or CGU (for example, a decline in market capitalisation to less than the carrying value of the entity’s net assets). This then may require the use of judgement to determine which assets or CGUs should be tested in response to an external source of information. The example below illustrates this point.

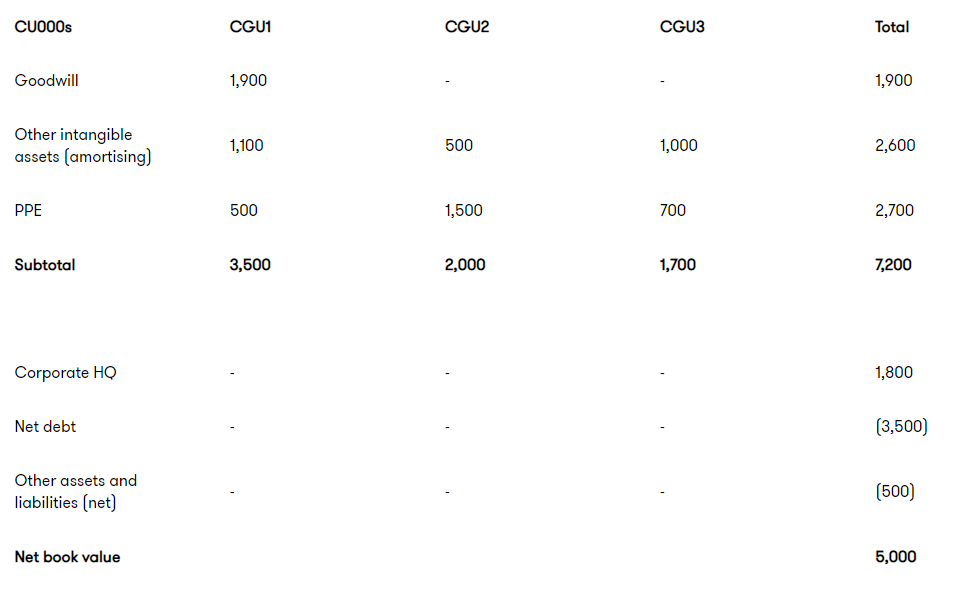

BioTech Research Company (BTRC) develops and sells a range of diagnostic products. It operates from three manufacturing and distribution hubs. Each hub is considered to be a separate CGU. BTRC is preparing its financial statements for its year-ended 31 December 20X1. Summary financial information for each CGU is as follows:

The market capitalisation of BTRC as at 31 December 20X1 is CU3,000.

As part of its indicator assessment, management should compare market capitalisation (CU3,000) with net book value (CU5,000). Given the seemingly material ‘market to book’ shortfall of CU2,000, a detailed impairment test is probably required. However, BTRC should consider all facts and circumstances, including:

- whether some or all of the shortfall is attributable to assets and liabilities outside IAS 36’s scope (eg if the fair value of the entity’s net debt is significantly different to its carrying value of CU3,500)

- whether any discounts or premia to the market capitalisation should be considered, to reflect control and liquidity

- the volume of trading the company’s shares

- share price volatility

- length of time over which a shortfall is observed

- the reason for any notable decreases in the market capitalisation and the extent to which management information is known to the market, and

- other possible impairment indicators.

If, after considering these factors management concludes that detailed impairment testing is required, the question arises as to which CGUs and assets should be tested. CGU 1 needs to be tested for impairment in any event because goodwill has been allocated to it; however determining the relevance of the market to book shortfall for CGU 2 and 3 will require BTRC to make a judgement after considering all facts and circumstances including:

- whether there is a reasonable basis to conclude that the market capitalisation to book value shortfall relates to a specific CGU or CGUs

- the existence or otherwise of other impairment indicators for each CGU or

- the results of impairment testing for CGU 1 (if CGU 1 is impaired, the market capitalisation to book value shortfall may be reduced or eliminated).

If BTRC is unable to link the shortfall to particular CGUs it may conclude that all CGUS should be tested for impairment.

In practice, an adverse trend might develop over a series of reporting periods (eg a decline in market demand). While an entity may not be able to pinpoint a specific event or moment when an adverse trend becomes an impairment indicator, adverse trends such as this clearly cannot be ignored. Management will need to factor these types of trends into its impairment review and use judgement based on the specific facts and circumstances to decide whether the adverse trend constitutes an impairment indicator.

Review useful life, depreciation/amortisation method, residual value

The existence of an impairment indicator may also suggest that the remaining useful life, depreciation (amortisation) method or the residual value for the asset needs to be adjusted. When an entity identifies an indicator of impairment, the remaining useful life, the depreciation (amortisation) method or the residual value of the asset should be reviewed (and adjusted if necessary) even if no impairment loss is recognised.

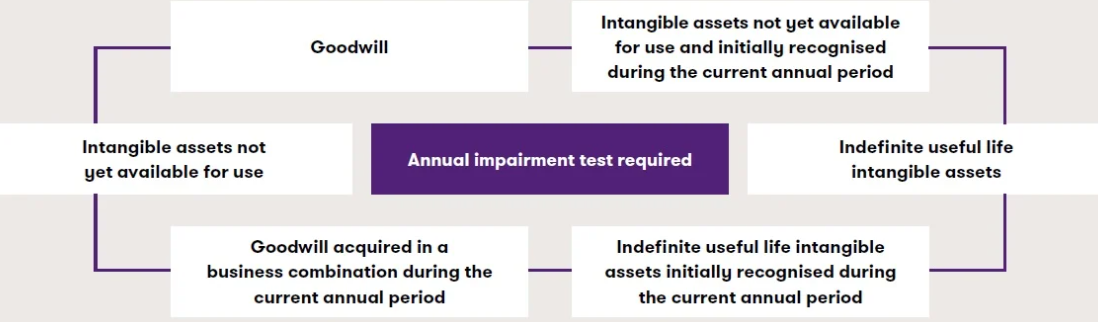

Annual impairment testing

The Standard requires an intangible asset with an indefinite useful life, an intangible asset not yet available for use and goodwill to be tested for impairment:

- when an indication of impairment exists, and

- at least annually, irrespective of indicators.

Further, the intangible asset and/or goodwill should be tested for impairment before the end of the current annual period if:

- the asset was initially recognised during the current annual period, or

- some or all of the goodwill allocated to the CGU under review was acquired in a business combination during the current annual period.

For a related discussion on the provisional allocation of goodwill, see our article ‘Insights into IAS 36 – Allocate goodwill to the cash

generating units’.

Timing of the annual impairment test

The annual impairment test for an asset may be performed anytime during the annual period provided the test is performed at the same time every year. Assets that are subject to annual testing may be tested at different dates provided the date is consistent whenever the test is undertaken. This provides some flexibility to spread the workload while providing a safeguard against manipulation.

Practical insight – Changing the annual impairment testing date

An entity may wish to change its annual impairment testing date, perhaps to align with the budget cycle or to reduce the testing burden in another period. IAS 36 is silent on this. In our view, a change of date is acceptable in reasonable circumstances subject to the entity demonstrating this has not resulted in avoiding an impairment loss. For example, an entity with a 31 December year-end might wish to change its testing date from 30 June to 31 December.

In the current annual period it could conduct tests at both dates, then test only at 31 December in the following annual period (assuming no indicators are identified at other period ends). In our view, paragraph 96 of IAS 36 serves as an anti-abuse provision which will not be breached if this approach is taken and the entity consistently tests at the new date on a go-forward basis. We do not regard moving to a new testing date to be a change in accounting policy. However, entities should consider disclosing the change and the reasons for it.

How we can help

We hope you find the information in this article helpful in giving you some insight into IAS 36. If you would like to discuss any of the points raised, please speak to our experts Christoph Zimmel and Rita Gugl.