-

Corporate Tax

We are your problem solvers for corporate tax issues

-

Restructuring, Mergers & Acquisition

Expertise and creativity for the perfect structure

-

International Tax

We are here, whenever our clients require our assistance

-

Transfer pricing

We are your experts for an optimal transfer pricing structure

-

Indirect Tax & Customs

We take care of your indirect taxes so you can take care of your business

-

Private Wealth

We are your competent partner in the field of Private Wealth Tax Services

-

Real Estate Tax

We are a valuable partner at every stage of your property's life

-

Global Mobility Services

Local roots and global networking as a secret for successful assignment management

-

Advisor for Advisor

As advisors for advisors, we support in complex situations

-

Accounting & Tax Compliance Services

Grant Thornton Austria - Your Partner for Experts for Accounting & Tax Compliance Services. In an evolving regulatory landscape, efficient accounting, tax compliance, and financial statement preparation processes are crucial for maintaining an accurate and up-to-date view of your company’s financial position while ensuring compliance with all legal requirements. We provide tailored solutions that not only save your time and resources but also ensure compliance with complex regulations. Our experts are here to support you, allowing you to focus on your core business.

-

Payroll & People Advisory Services

Ensuring Compliance, Efficiency, and Strategic HR Solutions In an evolving legal landscape, it is crucial for companies of all sizes to have efficient and legally compliant payroll accounting systems. The ever-changing regulations and increasing complexity make this an ongoing challenge. At Grant Thornton Austria, we provide comprehensive, precise payroll processing as part of our Payroll & People Advisory Services. Additionally, we offer customized advisory services to help clients optimise their HR strategy, improve operational efficiency, and minimize potential risks.

-

Tax Controversy Services

Your Partner when it matters most! In increasingly complex environment and considering frequent changes in tax regulations, businesses are facing intensified scrutiny from tax authorities. This has resulted in a significant rise of complex tax audits, investigations and potential disputes. Our Tax Controversy Services are tailored to help you navigate these challenges proactively and effectively. Our experts will guide you through all stages of tax proceedings, ensuring robust defence of your position and advising you on preventive measures to minimize the risk of future tax disputes.

-

Tax Technology Services

Your digital partner for an efficient future! In an increasingly digitalised business world, companies must constantly look for optimisations and adjustments to ensure their long-term success. In order to best prepare for the future and to achieve efficiency increases and process optimisations in the digital area, the experts at Grant Thornton Austria are at your side as a reliable partner as part of our Tax Technology Services.

-

Audit of annual and consolidated financial statements

We place particular emphasis on customized solutions and international service and adapt our services to your needs.

-

Assurance related advisory services

Assurance related advisory services are based on the knowledge and expertise that are the staff of life of our auditors.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

-

Accounting related consulting

Accounting in accordance with UGB, US-GAAP or IFRS is in constant motion. The integration of new regulations into their own accounting systems poses special challenges for companies.

-

Valuation

Valuations are a core competence of Grant Thornton Austria. As auditors and tax advisors we combine profound know-how with our practical experience to offer you customized solutions for your valuation assignment. Our industry expertise is based on years of services to our clients, including listed companies as well as owner-managed companies with an international focus. We advise on valuation matters related to arbitration and provide expert opinions.

-

Forensic Services

When it comes to risks in business, our experts are on hand. We support you not only in suspicious cases or in disputes, but also develop suitable strategies in the area of prevention to avoid serious cases as far as possible. Our Cyber Security team helps you to keep your networks and applications secure and is quickly on hand in the event of a security leak.

-

Cyber Security

Cyber incidents, IT system failures, the resulting business interruptions and the loss of critical data are one of the greatest business risks for companies. Recent cases underline the need for strategic protection and awareness of the issue and require a holistic approach and technical expertise that takes into account all legislative, regulatory and technical aspects of cyber security to protect companies against the daily increase in cybercrime incidents.

-

Sustainability Services

Sustainability is no longer a trend, but the only way to create a future worth living. Our experts will support you in successfully developing your sustainability strategy and preparing your sustainability reporting in compliance with regulations.

-

Transaction Support

We can support you throughout the transaction process – helping achieve the best possible outcome at the point of the transaction and in the longer term.

-

Merger & Acquisition

Companies start new activities and separate from old ones, cooperate and merge. Markets and competitive conditions are subject to constant and increasingly rapid change. As a result, existing business models are changing. Some companies have to restructure and reorganize. But new business opportunities also open up.

-

Restructuring & Going Concern Forecast

Restructuring & Going Concern Forecast: Bundled services for your strategic, operational and financial decisions offer the right answers for companies, banks, shareholders and investors.

-

Internal Audit

Internal Audit helps companies and organisations to achieve their goals by analysing and evaluating the effectiveness of risk management, controls and management and monitoring processes. Internal Audit focuses on independent and objective audit (assurance) and consulting services that improve the value creation and business activities of your company.

-

Expert dispute resolution & advisory

Grant Thornton Austria offers comprehensive services in the field of business-oriented expert services with a broad range of competencies from banking to communication. The core activity of experts is the objective recording of findings and the preparation of expert opinions - regardless of all external circumstances. Our experts Gottwald Kranebitter and Georg H. Jeitler, as sworn and court-certified experts, ensure that the highest professional standards and the principle of objectivity are observed.

-

Blockchain and Crypto-Asset

Blockchain as a carrier technology for crypto currencies and smart contracts, among other things, is becoming increasingly important. Grant Thornton Austria offers comprehensive audit and confirmation services for block chain technologies and business models.

-

International Project Coordination

Our International Engagement Management team is your central point of contact for international projects in all our service lines. We take care of operational project management for you and act as a central point of contact and coordination for your projects. We support companies that start international projects from Austria as well as companies from abroad that want to gain a foothold in Austria or use Austria as a hub for their international projects, especially in the DACH (Germany, Austria and Switzerland) and CEE region.

-

International Desks

As a member of the Grant Thornton network, we guarantee direct access to resources from our worldwide circle of partners. This global connection enables us to seamlessly integrate highly qualified specialists and industry experts from different countries around the world into our teams. Through our broad perspective and diverse expertise, we ensure that we can optimally meet the individual requirements of our clients in an increasingly globalised economy.

With high inflation widespread around the world and likely to persist into 2023, many mid-market companies are facing unprecedented challenges. As input costs rise and consumers rein in their spending, margins come under pressure and businesses find it harder to protect their profits and make effective investment decisions.

Grant Thornton’s International Business Report (IBR), a biannual survey of senior executives of around 10,000 firms in 29 economies, found that only 54% of respondents strongly agreed that they expected to increase profits in 2022 as inflation drags on-demand and pushes up input costs.

However, those firms that did forecast higher profits said they were:

- Investing in noticeably more areas of digital/IT than the global average

- Focusing more on reducing operational costs and improving efficiencies

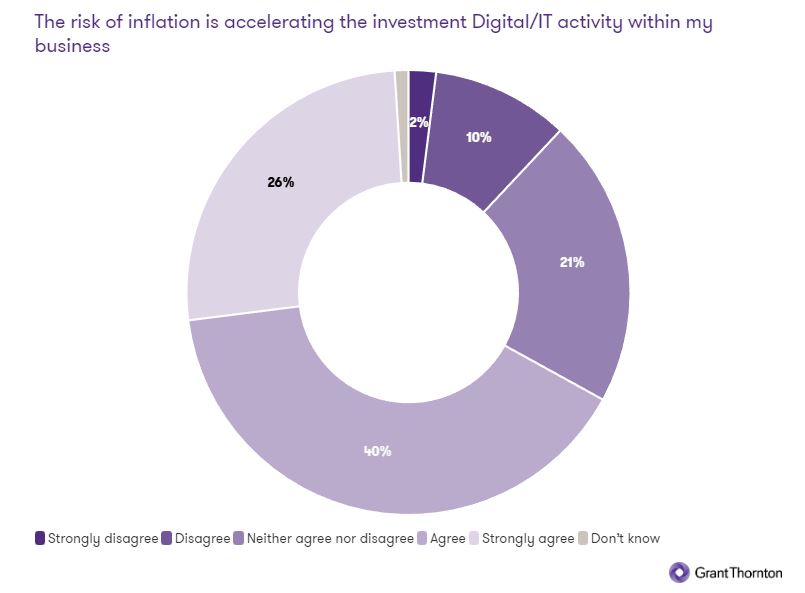

- Increasing digital spending as a direct result of inflation, with some 70% agreeing that “the risk of inflation is accelerating investment in digital/IT activity within my business” compared with the global average of 66%.

“High rates of inflation have a huge impact on companies by increasing the costs of doing business and creating market uncertainty,” explains Elaine Daly, global head of business consulting in Ireland for Grant Thornton.

“But well-planned and implemented business transformation initiatives can offset this, having a long-term deflationary effect on business costs and, subsequently, the price of products or services,” she adds.

“The key is that companies are not complacent and move quickly to build their digital resilience.”

Efficiency has become a priority and digital innovation is vital to achieving it. Companies must upgrade their systems and processes to develop leaner business models that can thrive at a time of slower growth. At the same time, digital transformation remains crucial to improving consumer engagement and unlocking productivity gains – a trend accelerated by the pandemic.

It all requires smart and sustained investment, and mid-market companies say they are willing to spend, with two-thirds of respondents to Grant Thornton’s most recent IBR survey agreeing that the risk of inflation is accelerating investment in digital within their business.

Businesses are looking to digital to mitigate the effects of inflation

We also found that 60% of companies plan to increase overall digital investment in the next 12 months – the highest level on record.

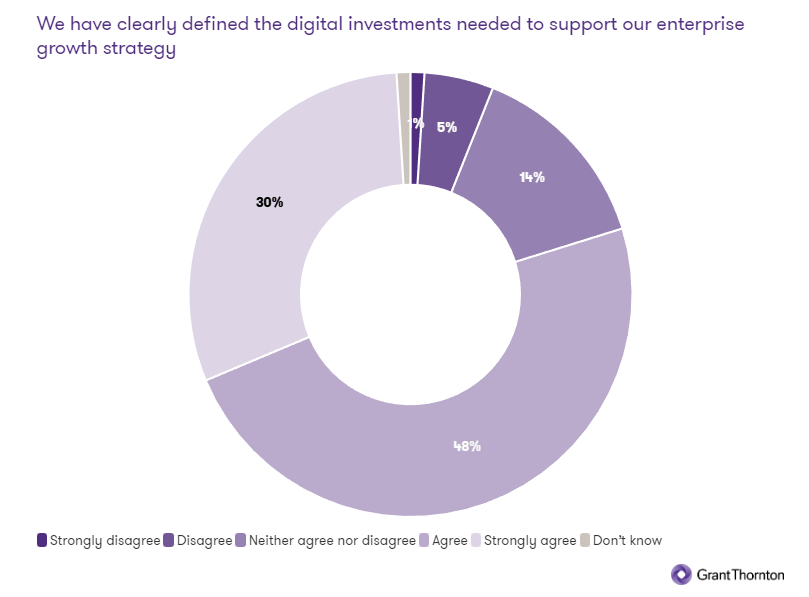

Yet, there are concerning signs that some businesses may be struggling to get the most out of their digital spend or are misdirecting it. Only 30% of IBR respondents strongly agreed that they had 'clearly defined' the digital investments needed to support their enterprise growth strategy. And only one-third said they were actively spending on digital to reduce costs.

Two-thirds of the mid-market lack clarity on the digital investments needed for growth

Why digital matters at a time of uncertainty

“We see that successful mid-market companies have invested heavily in technology over the last decade and especially in the last two or three years, but the business case has changed,” says Steven Perkins, national leader for technology and telecommunications industries at Grant Thornton US.

“Before inflation became a problem, the focus was on improving the customer experience and employee engagement in response to rising competition and the remote working trend. Those areas remain vital, but inflation has become an additional pressure and there’s a need to rationalise infrastructure and find efficiencies.”

Many mid-market companies have a “good deal of cash” on their balance sheets after a long period of expansion, which to some degree protects them, he says. Yet, no one believes high inflation will be transitory anymore and companies must adapt to a new reality for the medium to long term.

“You may be running a company that has been through a decade of growth but is now entering a sustained period of uncertainty,” Steven says. “That may require substantial upgrades to your technology and processes to create a fundamentally different or more efficient business model.”

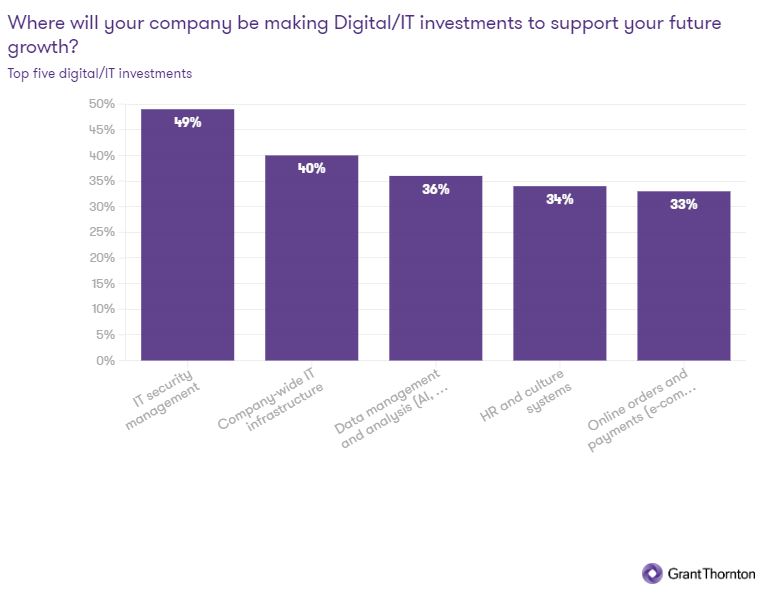

What does smart digital investment look like?

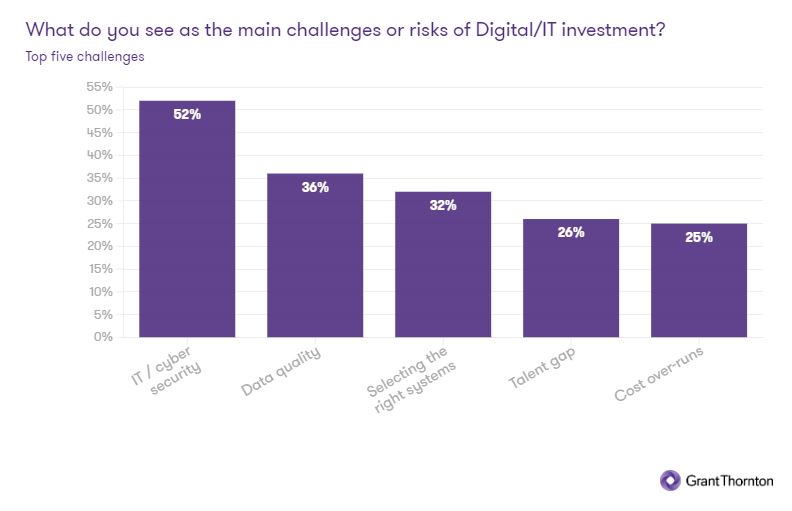

Companies need to harness digital to build smarter, leaner businesses that can withstand the impact of inflation and find new routes to growth. But for many, deciding how to deploy their digital budgets can be a challenge.

Technology is evolving rapidly and, in some instances, there is a fear of the unknown or unproven. Some mid-market firms are also grappling with cumbersome legacy systems that hinder innovation.

Steven says it is vital for mid-market businesses to update these systems and move to the cloud – or scrap them altogether and start again. Which route to take depends on a firm’s current and future business requirements, but he believes that long duration infrastructure projects are in decline.

“I think we'll see more upgrades and investments to unlock additional value from existing infrastructure. The cloud has allowed businesses to essentially rent digital capabilities and this asset- light approach makes the most sense at the moment.”

Roy Nicholson, national managing principal of the digital transformation practice at Grant Thornton US, adds that businesses shouldn’t fear digital transformation just because they are less well resourced. Mid-market firms actually have an advantage over larger organisations as their legacy infrastructure is smaller and therefore easier to update.

“They can be nimble in a way larger businesses cannot. That agility is crucial.”

Deciding how to deploy digital budgets requires meticulous planning, says Xavier Lecaille, global leader of business process solutions at Grant Thornton in France. Companies must evaluate the risks and returns before making significant investments and this is rarely straightforward.

In addition, new systems usually require an organisation-wide change to ensure staff are properly trained and management processes adapt. Personnel changes may be necessary.

It is vital that companies take advice before they invest and get buy-in from all stakeholders, adds Elaine Daly.

“Clients need to understand what the issues are and what the investment will deliver. Is the investment designed to reduce overhead costs, increase quality, increase productivity or add value? Are all the management team aligned on what the investment will and won’t do? Have key stakeholders been briefed and their issues or concerns been addressed?”

She says early engagement with key decision-makers and clear well documented plans, agreed by all parties to help ensure the successful delivery of transformation programmes, will be vital.

There is also fierce competition for digital talent among mid-market companies, explains Kalpana Balasubramanian, head of dGTL, a venture of Grant Thornton that focuses on emerging technologies and digital finance in India. “Growing firms need to find more skilled and educated workers who have many options and they push the cost of hire.”

“It’s a trend playing out across the world and a lot of companies will look to manage the higher cost more efficiently with technology.”

Some firms would rather outsource their digital functions than face up to these internal challenges, says Roy Nicholson, but it’s a mistake.

“Most mid-market firms can improve efficiencies internally, by simplifying, standardising and centralising processes first; outsourcing on its own transfers the mess to someone else without exploring efficiencies first,” he says.

Automation and data can unlock productivity

But what technologies specifically should mid-market firms invest in as they look to offset inflationary pressures?

Clearly, priorities differ from firm to firm, but for most, automation, robotics and machine learning will be key. These technologies improve productivity by lowering output costs and allowing companies to deploy manpower more effectively.

According to our survey, 30% of mid-market firms globally say they are investing in operational automation to fuel growth.

Data is also key to building more resilient mid-market businesses at a time of rising cost pressures, as it plays a critical role in informing a company’s decision-making processes. As pressures on margins increase, firms may face difficult decisions around cost-cutting, increasing prices or switching their product mix or suppliers. But with deeper insights into their operations, those choices become easier.

Data is a top priority for companies predicting growing profitability

“Many businesses struggled to make effective decisions during the pandemic because they lacked the data to understand the challenges and opportunities that lay ahead,” says Alan Dale, head of business consulting at Grant Thornton UK.

“Mid-market firms have been working to change this, but it will require continued focus and investment.”

He is seeing a lot of interest in enterprise resource planning, finance, HR and supply chain systems which can improve efficiency and cut waste.

Act now to offset the challenges

Inflation poses serious risks to today’s mid-market businesses and companies around the world must take action to offset the threats. The choices they make today will determine their future performance, yet many still seem to be misdirecting their IT spend, potentially letting it go to waste.

Security is a major concern in the mid-market

“As inflation bites, the biggest risk to mid-market firms is complacency,” says Steven Perkins. “Those that don’t adapt could be left behind by more agile rivals.”

Companies must therefore act now, using digital innovation to ensure they continue to thrive despite growing economic uncertainty.

Act now, but how?

- Interrogate your data to understand your primary challenge

- Use automation to cut back office costs

- Engage stakeholders early on digital investments

- Simplify and standardise internal processes

- Upgrade legacy systems to boost innovation

For more information about how your business could benefit from targeted digital investment, speak to you local Grant Thornton member firm or contact one of our Grant Thornton specialists highlighted below.